What happened to Iran’s currency?

Iran’s rial didn’t “suddenly collapse.” It’s been collapsing for years — and then it slipped into panic mode.

If you’re looking for a single villain-of-the-week headline (“one sanction did it!” / “one speech did it!”), that take is trash. Currencies don’t vaporize like this from one event unless the system underneath is already rotten.

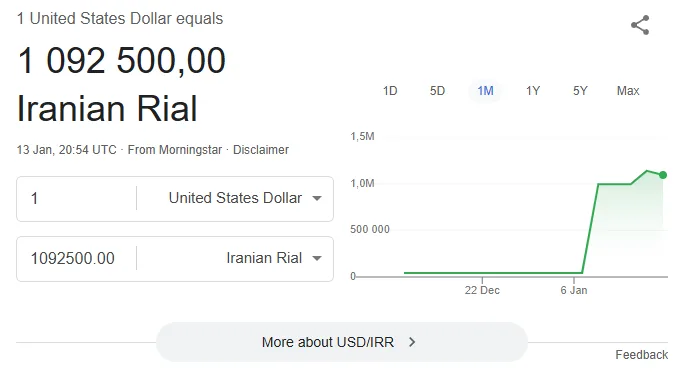

What happened to Iran’s currency is a slow-motion erosion—high inflation, sanctions, a broken exchange-rate regime, and political risk—punctuated by sharp air-pockets when confidence snaps. Early January 2026 is one of those air-pockets.

On Iran’s unofficial market, the rial fell to yet another record low, with the US dollar quoted around 1.47 million rials. That number is not just “a bad day.” It’s a signal that people inside the country are pricing in more inflation, more instability, and fewer credible tools to stop either.

The headline: record lows, leadership swaps, and a public that’s done pretending

When currencies break, you usually see three things in sequence:

1) The exchange rate gaps lower (official rhetoric stays calm) 2) Authorities blame “speculators” (instead of fixing the incentive structure) 3) Someone gets fired (as if replacing the dashboard changes the engine)

Iran is living that script. After the rial hit extreme lows and protests intensified, Iran appointed a new central bank governor after the prior governor resigned, with reporting tying the move to the currency’s slide and the public anger around inflation and living costs.

And that anger isn’t mysterious. Inflation in Iran has been running hot for years; the IMF’s country data shows projected consumer price inflation still extremely high (over 40% in 2026 projections). If you want a simple mental model: when people expect their money to buy less next month, they try to dump it this month. That behavior becomes the crisis.

“Rial” numbers are comically large for a reason — and it messes with how people think

Iran’s unit problem is not cosmetic; it’s psychological and operational.

- The official currency is the rial, but many Iranians quote prices in tomans (commonly used unit in daily life).

- Because the rial has lost so much purchasing power, normal transactions involve huge numerals, which increases confusion, accounting friction, and the temptation to “just index everything to the dollar.”

That’s why Iran keeps returning to redenomination as a political “solution.”

Iran’s parliament approved a plan to remove four zeros (effectively making 1 new rial = 10,000 old rials), with a preparation period and then a transition where both would circulate.

Here’s the ruthless truth: redenomination doesn’t fix anything. It can reduce transaction hassle and printing costs, sure—but without credible fiscal and monetary repair, it’s like repainting a burning house.

How bad is the long-term decline? “Bad” doesn’t cover it.

To understand why the public treats the rial like melting ice, zoom out:

- At the time of the 1979 revolution, reporting notes about 70 rials per US dollar; by early 2026 it had surged past 1.4 million in the parallel market.

- That’s not “volatility.” That’s a multi-decade credibility collapse.

And credibility is the real reserve currency here. When people no longer believe the central bank can defend purchasing power, they substitute their own anchors: dollars, gold, real estate, durable goods, even inventory.

The engine of collapse: inflation + sanctions + governance = a permanent confidence tax

Iran’s currency weakness isn’t one cause. It’s a system where each weak part amplifies the others.

#### 1) Chronic inflation is a currency’s slow death

High inflation means the domestic currency is constantly losing purchasing power. Unless the currency is supported by high interest rates, fiscal restraint, and trust, the exchange rate will keep bleeding to reflect that reality.

The World Bank has pointed to inflationary expectations and depreciation dynamics in Iran, describing how shocks can trigger further depreciation and elevated inflation (including strong food inflation).

The IMF projections reinforce the same ugly baseline: inflation remains extremely high in the forward outlook.

#### 2) Sanctions and external isolation squeeze supply of hard currency

Iran’s access to global finance is constrained, and sanctions pressure oil revenue collection, shipping, and settlement. Fewer reliable hard-currency inflows mean the central bank has less ammunition to stabilize markets—especially the unofficial market that actually sets expectations.

And once the street believes “dollars will be scarcer tomorrow,” the street buys dollars today.

#### 3) A politically captured economy undermines reform credibility

Even when policymakers know what needs to happen—cleaner banking, fewer distortions, less rent-seeking—implementation gets kneecapped by political constraints.

Recent reporting has highlighted how powerful internal actors shape Iran’s economy and why that worsens currency fragility.

Whether you agree with every framing or not, the mechanism is straightforward: when large parts of the economy operate through opaque power networks, trust and investment fall, and the currency pays the price.

The accelerant: multiple exchange rates (a legalized confidence scam)

Want a reliable recipe for corruption, mispricing, and constant FX crises? Run multiple exchange rates:

- an “official” rate (for selected imports and accounting)

- a “managed” rate for certain trade flows

- and a real rate—the unofficial market—where everyone goes when the official pipe is clogged

Multiple rates create a guaranteed arbitrage game: if someone can buy dollars cheaply through a privileged channel and sell or value goods at the market rate, they extract rents. That drains reserves and makes shortages worse.

Iran has wrestled with “preferential” rates and partial reforms; analysts examining the removal of preferential rates emphasize how these systems become destructive over time, even when they’re initially sold as protecting consumers.

Here’s the part people miss: the unofficial rate becomes the truth because it reflects scarcity and risk. Businesses price imports off it. Households track it. Speculators broadcast it. So even if the government posts a nicer number, expectations follow the uglier one.

Why late 2025 / early 2026 got worse: budgets, protests, and the fear spiral

Currencies don’t just reflect economics; they reflect political stress. When people sense unrest, they don’t wait around to see if stability returns—they hedge immediately.

Iran’s budget debate became part of that stress. Reporting on Iran’s government budget highlighted how the numbers look dramatically smaller in dollar terms at current exchange rates, and how the state leans harder on tax increases while facing pressure on oil revenues.

At the same time, protests and public anger intensified alongside the currency slide and inflation pressures, with authorities responding through warnings and leadership changes.

This is the fear spiral:

- People fear inflation → they buy dollars

- Buying dollars weakens the rial → import costs rise → inflation worsens

- Inflation worsens → more people buy dollars

It’s reflexive, and it doesn’t stop because an official says “calm down.”

“But oil prices!” — why commodity revenue doesn’t automatically save the rial

A lot of casual commentators make this mistake: “Iran has oil, so why is its currency weak?”

Because earning commodity revenue isn’t the same as accessing and recycling it into a stable financial system.

Even if oil exports bring inflows, sanctions can limit:

- who can buy

- how payments settle

- how funds move

- whether reserves can be deployed freely

Plus, if the government runs structural deficits and the banking system is stressed, commodity inflows get consumed by immediate fiscal needs rather than building credibility.

The human cost: a currency collapse is a pay cut for everyone paid in rials

A falling exchange rate hits living standards through three channels:

1) Import prices jump (food inputs, medicine, machinery, tech) 2) Domestic producers raise prices because their costs track the dollar 3) Savings get destroyed unless people hold assets that keep up

That’s why currency crises often show up as social unrest: people aren’t “debating macro policy.” They’re reacting to the fact that normal life becomes unaffordable.

And when the public starts treating the local currency as toxic, the state loses a hidden superpower: the ability to fund itself cheaply in its own money without immediate backlash.

What can Iran do? The real options are painful, and the fake options are cosmetic

Let’s separate real stabilization from performative stabilization.

#### Performative (doesn’t fix the problem)

- Arresting “speculators” (you can’t jail expectations)

- Printing bigger banknotes (that’s admitting defeat)

- Redenomination alone (removes zeros, not inflation)

- Setting an “official” rate nobody can access (markets ignore you)

#### Real stabilization (works only if credible) 1) Stop monetizing fiscal deficits. If the state keeps funding itself through monetary expansion, the rial keeps dying. 2) Unify the exchange rate over time with transparent rules, or at least narrow the gap. Multiple rates are a corruption engine. 3) Clean up banking and quasi-fiscal liabilities. Hidden losses in banks and state entities eventually get socialized through inflation. 4) Build an anchor. Either a credible inflation-targeting regime (hard with low trust), a managed peg with real reserves (hard under sanctions), or structural reforms that rebuild confidence. 5) Address external constraints. Like it or not, sanctions relief or credible pathways to it can change the FX supply/demand balance—without that, stabilization is fighting uphill.

None of this is easy. That’s the point. If it were easy, the rial wouldn’t be trading in the millions per dollar.

So what actually happened to Iran’s currency?

In plain English:

- The rial hit fresh record lows on the unofficial market (around 1.47 million per USD), showing that confidence deteriorated further.

- Inflation remains structurally high, and credible disinflation is not yet in sight in baseline projections.

- Political and social stress increased, and authorities responded with leadership changes at the central bank while warning protesters.

- Longer-term, the rial’s decline reflects decades of inflation and shocks, and policymakers are now leaning on measures like redenomination to make the currency usable—without that being a real fix by itself.

What to watch next (if you want to predict the next leg, not just narrate the last one)

If you’re trying to be early rather than loud, track:

- The gap between official/managed rates and the street rate (widening gap = worsening credibility)

- Inflation prints and especially food inflation (politically explosive)

- Fiscal choices in the budget: taxes, subsidies, fuel pricing, off-balance-sheet financing

- CBI policy actions: restrictions, liquidity measures, enforcement—do they reduce volatility or just push trading underground?

- External pressure: sanctions enforcement, trade constraints, and geopolitical risk premia

The rial can stabilize—but only if the policy mix becomes believable. Without credibility, every “stabilization” attempt becomes the next reason people sprint to the dollar.next reason people sprint to the dollar.